Loading...

Insurance is one of the oldest industries in the world. It's also one of the most data-intensive. Every policy is a bet. Every claim is a calculation. Every fraud attempt is a pattern hiding in noise.

AI thrives in exactly this environment. Lots of data. Clear decision rules. High cost of errors. Massive volume of repetitive tasks. Insurance was practically built for AI optimization.

Claims Processing in Minutes, Not Weeks

Filing an insurance claim has historically felt like a punishment for having insurance in the first place. You fill out forms. You wait. Someone reviews your documentation. They request more documentation. You wait again. Eventually, weeks later, you get a decision.

AI claims processing compresses this timeline from weeks to minutes for straightforward claims.

The AI agent reviews submitted documentation automatically. Photos of vehicle damage get analyzed by computer vision models that estimate repair costs. Medical bills get cross-referenced against policy coverage limits. Property damage assessments get compared to similar claims in the database for consistency.

For simple, clear-cut claims, a fender bender with photos and a police report for example, AI handles the entire process end-to-end. Validate coverage. Estimate damage. Calculate payout. Issue payment. No human touches the file. The claimant gets their money in hours instead of weeks.

Complex claims still go to human adjusters. But they arrive pre-analyzed. The AI has already reviewed documentation, identified coverage questions, estimated a range of outcomes, and flagged areas that need human judgment. The adjuster starts with analysis, not paperwork.

The speed improvement isn't just a convenience upgrade. When your house floods, waiting three weeks for a claims decision isn't just annoying. It's financially devastating. Faster claims processing is a genuine improvement in people's lives during their worst moments.

Fraud Detection That Saves Billions

Insurance fraud costs the industry an estimated $80 billion per year in the US alone. That cost gets passed directly to honest policyholders through higher premiums. Everyone pays for fraud.

Traditional fraud detection is reactive and slow. An investigator reviews a claim that something feels off about. They pull records manually. Cross-reference details. Interview claimants. The investigation takes weeks and catches only the most obvious cases.

AI fraud detection operates at a completely different scale and speed.

Pattern recognition across millions of claims identifies statistical anomalies that no human could spot. A claimant who files suspiciously similar claims with different insurers. A repair shop that consistently estimates higher than average. A medical provider billing for treatments that don't match the diagnosis codes. An address that appears across an unusual number of unrelated claims.

The AI doesn't accuse anyone. It flags claims for review with a fraud probability score and the specific indicators that triggered the flag. Human investigators then focus their time on the most suspicious cases with the most evidence already assembled.

Early detection is the real win. Catching a fraudulent claim before payment saves the full amount. Catching it after payment means costly recovery efforts that rarely succeed in full. AI catches fraud at submission time, before a single dollar goes out the door.

Insurers deploying AI fraud detection save 5-10% of total claims costs. On a portfolio of billions in claims, that's hundreds of millions in savings. Savings that should, in theory, reduce premiums for everyone else.

Risk Assessment Beyond the Actuarial Table

Traditional actuarial models are brilliant but limited. They work with the data points that fit neatly into tables. Age. Location. Vehicle type. Credit score. Claims history. These factors predict risk at a population level. They're blunt instruments for individual risk.

AI risk models incorporate a much broader range of signals. Telematics data from connected cars shows actual driving behavior, not just demographic proxies. IoT sensors in buildings provide real-time data on fire risk, water damage potential, and structural integrity. Satellite imagery assesses property-level flood and wildfire exposure more precisely than zip-code-level maps.

The result is more granular, more accurate risk pricing. A safe driver in a high-risk zip code gets a better rate because their actual behavior data proves they're low risk. A well-maintained commercial building gets lower premiums because sensor data demonstrates proactive maintenance.

Better risk assessment benefits everyone. Good risks pay less. Bad risks pay more, which incentivizes improvement. Insurers build more profitable portfolios because they're pricing more accurately. And the market becomes more efficient overall because prices reflect actual risk instead of broad statistical categories.

The Policyholder Experience

Beyond operations, AI transforms how people interact with their insurance company. AI agents answer policy questions instantly. Coverage recommendations get personalized based on actual needs, not upselling targets. Renewal offers reflect individual circumstances.

Insurance stops feeling like a grudging transaction and starts feeling like a service. That's a competitive advantage in an industry where customer satisfaction has been an afterthought for decades.

The insurers deploying AI right now aren't just cutting costs. They're building a fundamentally different relationship with their policyholders. Faster claims, fairer pricing, proactive service. When insurance actually works the way it's supposed to, customers stay. And they tell their friends.

Related Articles

AI in Finance: From Analysis to Automated Compliance

Financial institutions deploy AI agents for market analysis, risk assessment, regulatory compliance, and customer advisory services.

AI in Legal: Automating Research, Drafting, and Case Management

Law firms use AI agents for legal research, contract analysis, document drafting, and case management -- reducing costs while improving accuracy.

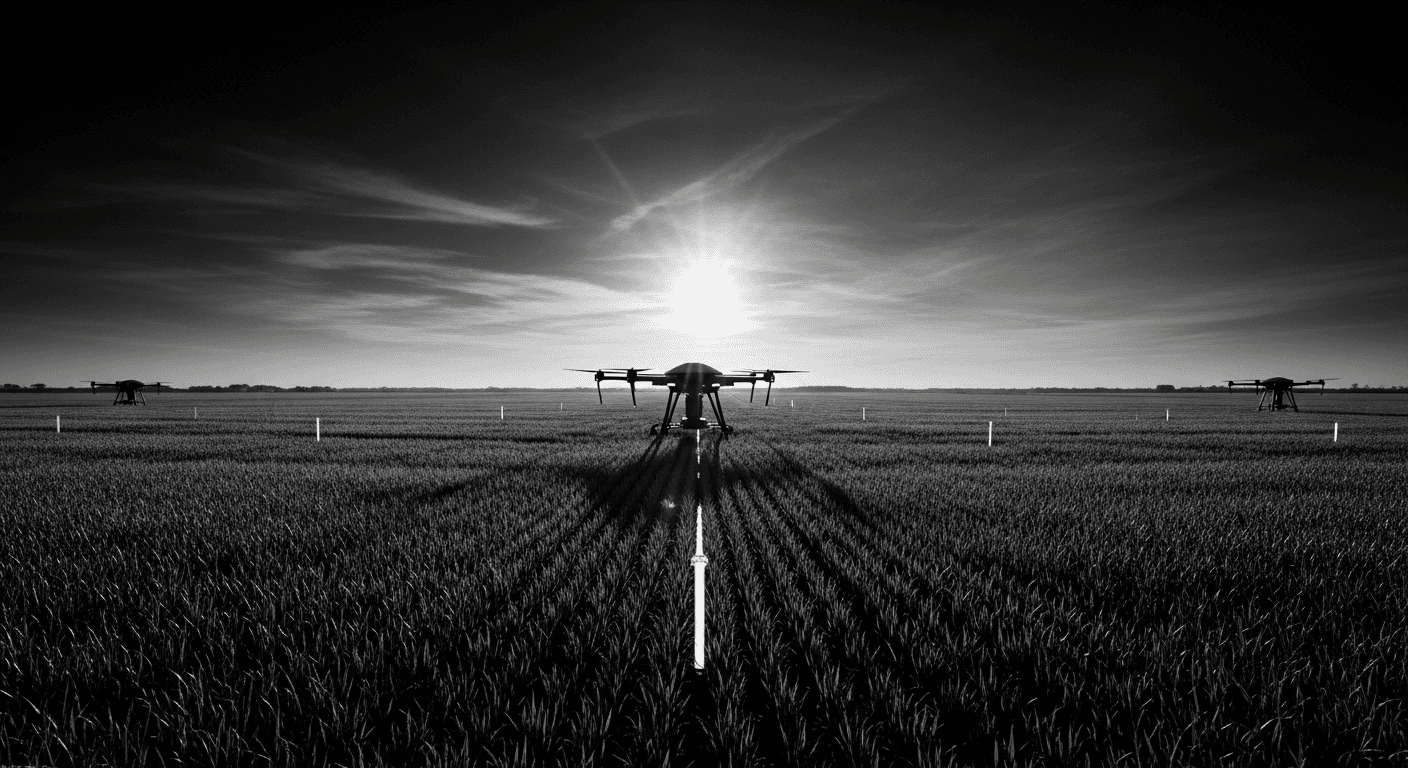

AI in Agriculture: Precision Farming and Crop Intelligence

Agricultural operations use AI for crop monitoring, yield prediction, resource optimization, and sustainable farming practices.

Want to Implement This?

Stop reading about AI and start building with it. Book a free discovery call and see how AI agents can accelerate your business.