Loading...

Finance runs on data. Always has. Spreadsheets. Models. Reports. Forecasts. The entire industry is built on processing numbers and making decisions from patterns.

Which is exactly why AI agents fit here like they were custom-built for the job.

Financial services firms were early adopters of machine learning for a reason. The data is structured, the outcomes are measurable, and the ROI calculation is straightforward. But what is happening now goes beyond the algorithmic trading and fraud detection systems that have been around for years. AI agents are handling the daily operational work that consumes entire departments.

Market Analysis at Machine Speed

A human analyst can track maybe 50-100 data points meaningfully. They can read earnings reports, monitor sector trends, follow macroeconomic indicators. They are good at synthesis and judgment. They are terrible at volume.

An AI agent processes thousands of data points simultaneously. Earnings transcripts from every company in a sector. Sentiment analysis across news and social media. Correlation patterns between seemingly unrelated economic indicators. Supply chain data. Weather patterns affecting commodity prices. Shipping volumes. Consumer spending trends.

The AI does not replace the analyst's judgment. It replaces the analyst's research time. Instead of spending Monday through Wednesday gathering data and Thursday synthesizing it, the analyst gets a comprehensive briefing at 7 AM Monday morning and spends the week on strategy.

The firms using AI for market analysis are not making better predictions than firms without it. Predictions in financial markets remain hard regardless of tools. But they are making more informed decisions faster. When a market-moving event happens, they understand the implications across their entire portfolio within minutes rather than hours.

Compliance Monitoring That Never Sleeps

Regulatory compliance in financial services is a nightmare. Not because any single regulation is impossibly complex, but because there are so many of them, they change frequently, and the penalties for violations are severe.

Traditional compliance means periodic audits. A team reviews a sample of transactions against regulatory requirements. They find violations weeks or months after they occurred. The firm pays fines. Processes get updated. The cycle repeats.

AI agents monitor every transaction in real-time against the full regulatory framework. Not a sample. Every single one. They flag potential violations immediately, before they become patterns. They generate compliance reports automatically instead of requiring analysts to compile them manually.

One mid-size bank told me their compliance team went from spending 60% of their time on monitoring and reporting to spending 60% of their time on strategic compliance initiatives. Same headcount. Dramatically different output. The AI handles the surveillance. The humans handle the judgment calls and process improvements.

The cost reduction is significant too. Compliance departments at major banks employ hundreds of people. AI does not eliminate those roles, but it changes what those people do. And it catches things that periodic sampling misses.

Customer Advisory at Scale

Wealth management has always been a two-tier system. High-net-worth clients get personalized financial advisors. Everyone else gets generic products and automated phone menus.

AI is collapsing that divide. Customer advisory AI analyzes an individual's financial situation, income patterns, spending habits, goals, risk tolerance, and tax situation. It provides tailored recommendations that were previously only available to people with $500,000+ in investable assets.

The quality of advice matters here. A generic recommendation to "save more and invest in index funds" is technically correct but useless. AI advisory that says "based on your current spending, you can redirect $340/month into a tax-advantaged account, and here is exactly how to set that up" is actionable.

The robo-advisor market has been around for years, but early versions were simplistic. Current AI advisory systems understand nuance. They factor in life events, career trajectory, family situation. They do not just optimize for return. They optimize for the client's actual goals.

Risk Assessment Gets Smarter

Risk assessment in banking and insurance traditionally relies on historical models with fixed variables. Credit scores. Debt-to-income ratios. Industry default rates. These models work, but they are backward-looking and slow to adapt.

AI risk assessment models incorporate real-time data alongside historical patterns. They detect shifts in risk profiles before traditional models would flag them. A business client whose payment patterns change subtly, whose industry is facing headwinds that have not yet hit the numbers, whose supply chain shows early stress signals. AI catches these patterns early enough to act.

The flip side is equally valuable. AI identifies creditworthy borrowers that traditional models reject. People and businesses with non-traditional financial profiles who would be good credit risks but do not fit the standard scoring criteria. Expanding access to credit while maintaining risk standards is not a contradiction. It requires better data analysis. AI delivers that.

What Finance Gets Right About AI Adoption

The financial services industry approaches AI adoption differently than most sectors. They measure everything. Every AI implementation has clear KPIs, defined ROI targets, and rigorous testing against human baselines.

That discipline means fewer failed implementations and faster scaling of what works. Other industries could learn from this approach. Do not deploy AI because it sounds innovative. Deploy it because you can measure the improvement. Then measure it. Then scale what works and kill what does not.

The institutions winning with AI in finance are not the ones with the biggest technology budgets. They are the ones with the clearest understanding of which problems AI solves and which it does not.

Related Articles

AI in Legal: Automating Research, Drafting, and Case Management

Law firms use AI agents for legal research, contract analysis, document drafting, and case management -- reducing costs while improving accuracy.

AI in Insurance: Faster Claims and Better Risk Assessment

Insurance companies deploy AI for claims processing automation, fraud detection, risk modeling, and personalized policy recommendations.

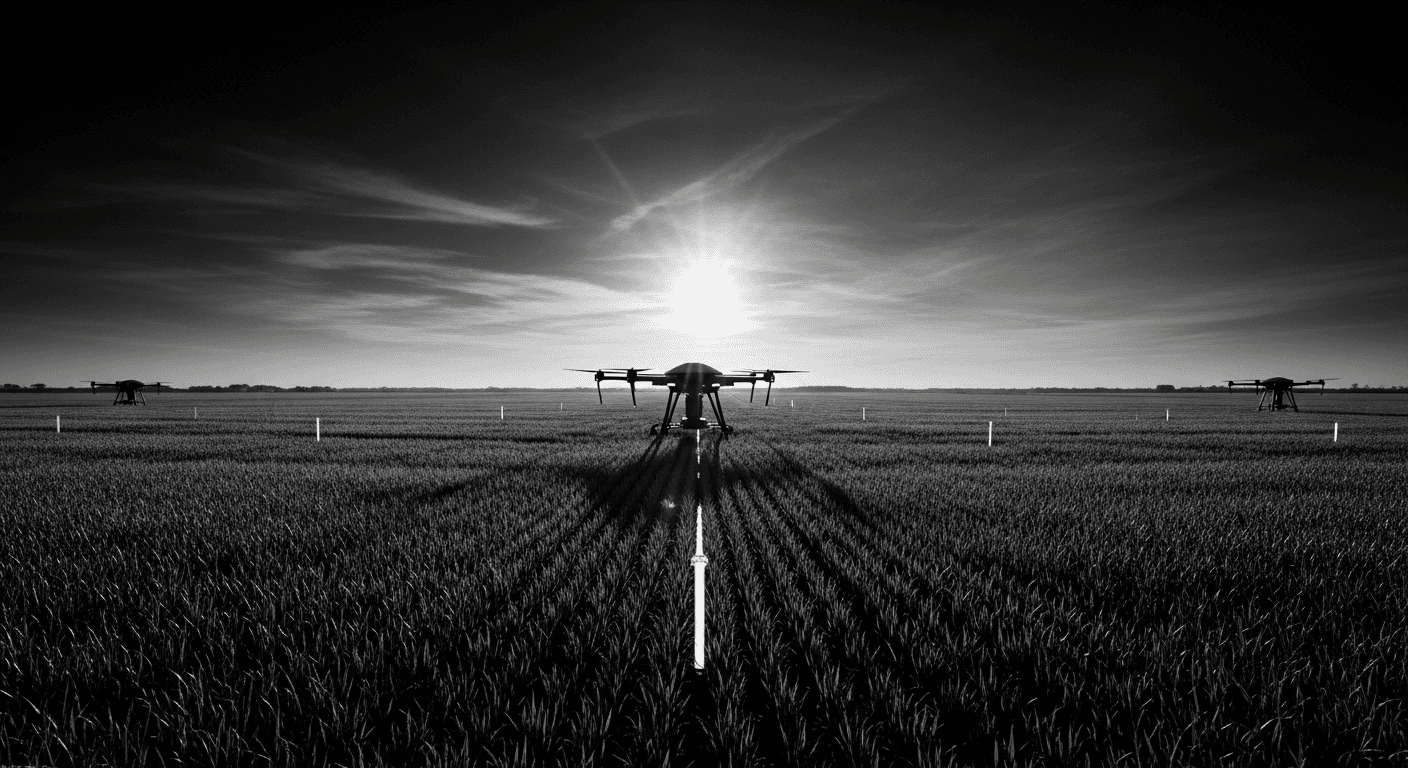

AI in Agriculture: Precision Farming and Crop Intelligence

Agricultural operations use AI for crop monitoring, yield prediction, resource optimization, and sustainable farming practices.

Want to Implement This?

Stop reading about AI and start building with it. Book a free discovery call and see how AI agents can accelerate your business.